The United States of America has built a global order following World War II that has benefitted America because every other country on Earth wanted to participate in it. This international order has led to America becoming the sole global superpower. It has enabled the economic success we call the American Dream to be the envy of the world. Unfortunately, this world order that has been beneficial to every American is now unraveling. One sign of this is the discussion around a one world currency. If we don’t stop this unraveling, it will significantly erode our quality of life.

The G7 and BRICS

Photo: Flags of the G7 nations.

Institutions like the Group of 7 (G7), the International Monetary Fund (IMF), and the World Bank are part of this American-led order. The G7 is an informal alliance of industrialized democracies. This alliance includes the US, Canada, France, Germany, Italy, Japan, and the UK. It meets annually to discuss topics like global economics, international security, and energy. It formed in 1975 to address economic concerns like inflation and a recession, triggered by the OPEC oil embargo.

From Gimmick to Institution

Newer organizations like the BRICS alliance are challening the role and influence of U.S.-backed entities like the G7. Brazil, Russia, India, China, and South Africa held the first BRICS summit in 2009. Now, they are trying to build alternatives to existing international financial systems and political forums. Their membership is expanding to countries like Bangladesh, Egypt, and the United Arab Emirates.

In the early 2000’s, the term BRICS was first coined as a marketing gimmick to capture the optimism of investing in some of the world’s fastest-growing economies at the time. Since 2009, the BRICS nations have met annually at formal summits to discuss matters of economics, monetary policy, politics, and security.

They have even created institutions for mutual benefit, like the New Development Bank (NDB) and the Contingent Reserve Arrangement (CRA). The NDB funds infrastructure projects in BRICS and other emerging economies, and the CRA provides a safety net to any member country if their own currency face a crisis.

Calls for One Currency

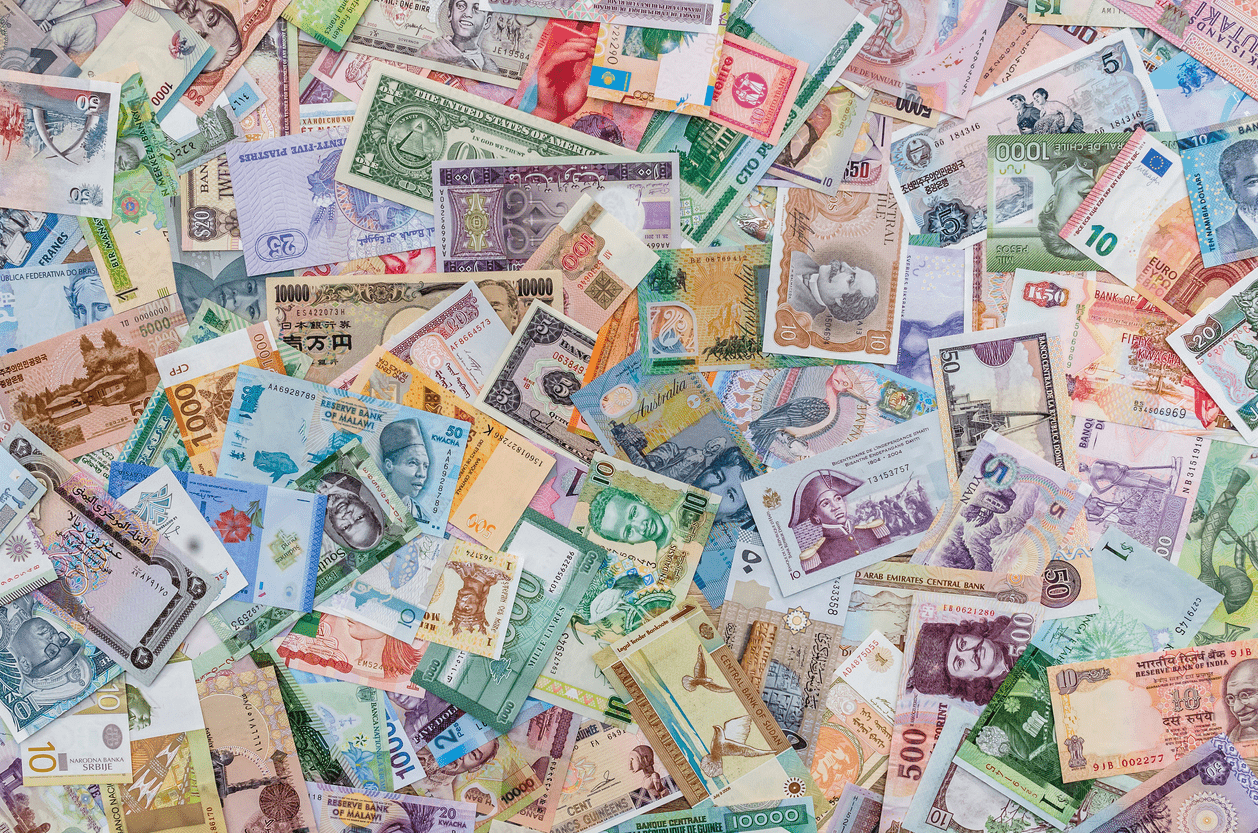

Photo: Foreign currency from around the world.

For more than a decade, China and Russia have been trying to lessen their dependency on the U.S. dollar. They want to safeguard their economies from U.S. sanctions, minimize vulnerability to U.S. economic and monetary policy fluctuations, and claim a stronger position in the global economic hierarchy. This furthers China’s efforts to surpass the U.S. as the global superpower..

Other leaders of BRICS nations have been critical of the role of the United States in the global order. Brazilian President Luiz Inácio Lula da Silva has lamented, “Every night I ask myself why all countries have to base their trade on the dollar.”

Such sentiments highlight the complexities nations face when tethered to a dominant currency. One of these complexities is currency risk. Currency risk, also known as exchange rate risk, refers to the potential for financial loss resulting from fluctuations in exchange rates. As nations like those in the BRICS alliance consider alternatives to the U.S. dollar, understanding and managing this risk becomes paramount.

To address this sentiment felt by many within the bloc, the BRICS group of nations has discussed the feasibility of introducing a common currency at their various summits. Some are concerned that a global currency would upend the international monetary system.

Understanding the Concept of a One World Currency

Photo: Treasury Secretary Henry Morgenthau Jr. and John Maynard Keynes in Bretton Woods, New Hampshire. Alfred Eisenstaedt, Time & Life Pictures (July 1944)

A one world currency implies a scenario where all nations abandon their own currency in favor of a single, universal one. A common currency is not a new concept. In the 1940s, British economist John Maynard Keynes famously proposed one currency to manage international trade imbalances to simplify and stabilize global finance. In the 1970s, during debates about a new international currency system, people discussed the concept of a common currency then.

Under a global currency scenario, all nations would use one currency for both domestic and international transactions. It would also necessitate the establishment of a global monetary policy authority and potentially one world government. Just like the European Central Bank was created by the European Monetary Union to regulate the euro, a supranational monetary union would need to regulate this single world currency.

This new world currency would eliminate the uncertainties and complexities of exchange rate and currency fluctuations, and could potentially reduce transaction costs, boost global economic growth, and increase economic interdependence. Proponents of a single world currency, believe by having a unified global currency, international trade could become more streamlined, reducing transaction costs and making cross-border business more efficient.

National Currencies Matter

However, it would also mean the elimination of each country’s own currency and surrendering monetary policy control to a global central bank.

- A national currency, intrinsic to a country’s identity and economic autonomy, serves as a primary medium of exchange within its borders. Its value, influenced by various domestic and international factors, plays a crucial role in determining the economic health of a nation.

Each country would lose its ability to pursue independent monetary policy to adjust interest rates, control money supply, and utilize currency as a tool to manage its own economy.

The practicality of a global monetary system would require significant advancements in international cooperation, trust, and financial infrastructure. Even more concerning would be the need for countries to give up their national sovereignty. This is a very hard sell, and something the United States government should never pursue. The risk of giving too much power to China and others is too high.

When Will the New World Currency Begin?

Photo: The headquarters building of the New Development Bank (NDB) Shanghai. (Xinhua/Fang Zhe)

In the ever-evolving realm of international finance, this recurring question continues to emerge: when will the new world order currency begin? People have debated the idea of a global currency replacing each country’s currency for years, but significant economic considerations make its realization challenging.

Emerging economies, despite their growing influence on the world economy, face numerous obstacles in pushing for a unified currency. Institutions like the European Central Bank and the New Development Bank have explored the idea, but the complexities involved in replacing individual currencies with a single global one are immense. The New Development Bank, established by the BRICS nations, has highlighted potential benefits for emerging economies, but the practical challenges are daunting.

One of the primary economic considerations is the volatility that individual currencies face, especially in emerging markets. While a unified global currency might offer stability, the intricacies of merging different financial systems and the diverse economic conditions of countries make it a monumental task. This would necessitate unprecedented cooperation between central banks, including the European Central Bank, and other major financial institutions.

The Complexities of a One World Currency

Moreover, the transition to a new world currency would demand significant alterations in global finance structures and international monetary system. While development banks could play a role in facilitating this, the inherent challenges of political differences, economic disparities, and the sheer magnitude of integrating multiple financial systems cannot be understated.

Given these complexities and the vested interests of individual nations in maintaining their own currencies, the prospect of one currency for all the world remains more theoretical than practical. While discussions around it will continue, the actual implementation of such a currency on a global scale seems unlikely in the foreseeable future. One example of this reality transpired in the August 2023 BRICS summit in Johnannesburg, South Africa where the BRICS nations articulated a preferece to reduce the reliance on the U.S. dollar and promote the use of national currencies in international trade.

While a global currency is very unlikely, this growing global financial trend of de-dollarizatoin is what can affect the American economy and every American’s quality of life.

The Process of De-dollarization and Its Global Impact

Photo: Chinese Bank Notes. The renminbi (RMB) is the official name of China’s currency and its principal unit is called the Chinese yuan (CNY). One yuan can be further divided into 10 jiao and 10 fens make 1 jiao.

The BRICS nations have been trying to weaken the role of the U.S. dollar in international transactions. This process, led by China and Russia, is known as “de-dollarization.” The U.S. dollar has long been the world’s reserve currency, giving the U.S. significant global economic influence.

De-dollarization could potentially affect global economic stability even if the movement towards a common currency never materializes. Countries shifting away from the U.S. dollar could cause significant currency fluctuations. This in turn would cause exchange rates to rise and fall disrupting international trade. For the average person, this could mean several things. It could lead to changes in the cost of imported goods, shifts in job markets, and fluctuations in interest rates. The inflation of the last two years may pale in comparison to the impact on American families with this kind of volatility.

The U.S. Dollar as a Reserve Currency and Its Impact on the American Economy

Photo: The U.S. Federal Reserve

The U.S. dollar has long been the world’s dominant reserve currency. Central banks around the world hold large amounts of American dollars in their foreign exchange reserves. The greenback has reigned supreme in international commerce for two big reasons. One, the United States makes up the largest share of the world economy. Two, the majority of commodities worldwide, including oil, is valued and traded in U.S. dollars.

This status provides several benefits to the American economy:

- The demand for the U.S. dollar as a reserve currency helps keep its value relatively stable. This enables the United States to borrow money at lower interest rates. This, in turn, allows the government to finance public spending and stimulate economic growth.

- The dollar’s reserve currency status boosts the global demand for American goods and services. As countries maintain their reserves in U.S. dollars, they are more inclined to import from the United States. This benefits American businesses and the overall American economy.

Consequences of De-Dollarization

If the dollar were to lose its status as the world’s reserve currency, several negative consequences could follow:

- Decreased demand for the dollar: With reduced demand for U.S. dollars, the currency’s value would likely decline, leading to higher import prices and potentially contributing to inflation.

- Higher borrowing costs: The United States would no longer enjoy the advantage of low borrowing costs, resulting in increased interest rates on government debt and making it more expensive to finance public spending.

- Reduced global influence: Losing the reserve currency status could diminish the United States’ influence in international financial markets and global trade.

To be clear, the U.S. dollar remains the dominant currency in global foreign exchange reserves. However, its share has dropped from more than 70% in 1999 to the high 50s now, based on data from the International Monetary Fund.

BRICS Nations and Their Steps Toward De-dollarization

China has been promoting the use of its currency the yuan in international trade and investment. Other countries have been calling for trade to be carried out in other currencies besides the U.S. dollar. Everyone from Brazil to Southeast Asian nations have joined this effort.

Based on International Monetary Fund data from 2022, CNBC has found that mainland China was the largest trading partner to 61 countries when combining both imports and exports. When doing the same calculation, the U.S. was the largest trading partner to 30 countries.

Other countries, such as Russia and Iran, have been exploring alternative payment systems. They want the ability to bypass the U.S. influenced international monetary system and avoid economic sanctions. For example, in 2017, Russia launched a new payment system called Mir. This enabled transactions in Russian rubles and is intended to reduce Russia’s dependence on the U.S. dollar.

The Impact of Digital Currencies on the Global Currency Debate

The rise of digital currencies, notably cryptocurrencies and central bank digital currencies (CBDCs), has complicated the debate over a global currency.

Cryptocurrencies, such as Bitcoin and Ethereum, are digital assets that operate on decentralized networks and offer increased transparency and security. However, they are highly volatile and lack regulation. These realities pose a threat to the stability of the global financial system if adopted as a common currency.

China is at the forefront of this digital currency revolution with its Digital Currency Electronic Payment (DCEP) project. This is far from a one-world currency now. However, it does represent a significant shift in the way nations approach money. It could influence future discussions about a global currency.

China’s CBDC and the Pursuit of One World Currency

Photo: An E-CNY app is displayed on a mobile phone in Ganzi, Sichuan Province, China. Costfoto/Future Publishing via Getty Images (Jan 4, 2022)

China’s DCEP project is their version of a Central Bank Digital Currency (CBDC). A CBDC is a type of digital currency issued and regulated by a country’s central bank. Cryptocurrencies like Bitcoin are decentralized and operate on a blockchain network without any central authority. Alternatively, a CBDC is centralized and is equivalent in value to the country’s traditional fiat currency. It’s also influenced by a country’s monetary policy.

China’s CBDC is referred to as an e-yuan (e-CNY). It’s development has raised questions about China’s ambitions in the global financial system. The Chinese government is push for the internationalization of the yuan through its CBDC. This move should be interpreted as an attempt to challenge the dominance of the U.S. dollar.

The primary idea behind a CBDC is to provide a digital form of a nation’s fiat currency. Something that is legally accepted throughout the country. It represents a claim against the central bank of the country, just like cash. A CBDC is often proposed to function alongside traditional forms of money.

e-CNY: The One Currency to Replace Them All?

It’s not a difficult to envision the e-CNY could become the default protocol for all retail and personal financial transactions. It could replace China’s leading mobile payment platforms like Alipay and WeChat. These are chinese apps comparable to U.S. services such as Apple Pay, Google Pay, Venmo, and PayPal.

This would enable the Chinese government to trace virtually all monetary transactions, freeze accounts, and even modify balances. As explained in a report from the Hoover Institution, the e-CNY could potentially become a significant tool for penalizing Chinese citizens for their social or political activism or criticism of the government.

The adoption of China’s Central Bank Digital Currency as a global currency would require global consensus. This is unlikely to be achieved easily, given the diverse economic interests of countries worldwide. Additionally, the United States’ economic influence and the dollar’s current status as the world’s reserve currency make it difficult for any single currency to displace it in the near future.

However, the advent of digital currencies and the trend towards de-dollarization suggest that changes are afoot in the global monetary system.

Bottom Line

Photo: The grand opening of the first McDonald’s in the Soviet Union on January 31, 1990. It set a record at that time for the most customers on opening day by serving 30,000 Muscovites.

The idea of a one world currency seems far-fetched. However, attempts by economic blocs like the BRICS to de-dollarize or lessen their dependency on the U.S. dollar pose significant challenges to U.S. foreign policy. These efforts impact the U.S. dollar’s status as a reserve currency and erode national monetary policy options. Furthermore, these efforts increase global tensions at a time when several conflicts could escalate into larger confrontations. To understand these potential flashpoints, read my analysis at “Three Conflicts That Could Turn Into World War 3.”

We should pay attention to these concerted efforts of nations to reduce their reliance and interdependence on the United States. They underscore a shift in global economic dynamics. Our leaders should view these efforts as a sign of resistance to U.S. financial hegemony. Efforts to de-dollarize, whether succcessful or not, necessitate a recalibration of U.S. foreign policy. We will need to change if we want to ensure continued global engagement and influence.

It’s the Thought that Matters

The fact that countries are even thinking of de-dollarization is a problem and a sign of more problems to come. It is a sign that American cultural, military, and economic influence around the world is less desirable than before. In some places, people view American influence as something to fear.

Former Federal Reserve Board member Kevin Warsh said, “The dollar’s persistent, outsized role in global markets is also a function of network effects: The more people use the dollar, the more valuable it becomes. And the harder it is to dislodge.” The opposite of this is true too. The less people use the dollar, the less valuable it becomes and the easier it is to dislodge.

To strengthen our economic position and preserve the United States’ ability to prosper in the global financial system we have built over the last 80 years, we need more people wanting to use the dollar because it makes too much sense for them not to.

First time reading? If you want rational takes on foreign policy, politics and technology then sign up below or click here for “The Brief.” It’s a twice-a-month email covering topics that deserve discussion but are currently overlooked, all in 5 minutes or less.